Unlocking Success in Business and Ensuring Your Future Security with Comprehensive Insurance Solutions

Introduction to Business and Personal Insurance: Building a Secure Future

In today’s dynamic economic environment, business owners and individuals alike face numerous challenges that threaten their financial stability and long-term growth. Effective risk management through comprehensive insurance coverage is crucial in safeguarding assets, securing livelihoods, and providing peace of mind. At im-insured.co.uk, we specialize in tailored insurance solutions such as Auto Insurance, Life Insurance, and Home & Rental Insurance designed to meet the unique needs of our clients.

Why Insurance Is Fundamental to Business Success

Business insurance is not just a legal requirement in many cases; it is a vital component of strategic planning that enhances resilience. By investing in robust insurance policies, companies can mitigate risks associated with accidents, theft, natural disasters, and liability claims. Furthermore, insurance encourages confident decision-making, enabling entrepreneurs to focus on growth and innovation.

The Core Categories of Business Insurance

- Auto Insurance: Protects company vehicles, equipment, and employees on the move.

- Life Insurance: Secures the livelihoods of employees' families and ensures business continuity.

- Home & Rental Insurance: Covers business premises, rental spaces, and assets housed within.

Autonomous Protection: Auto Insurance for Business Vehicles

Auto Insurance is a cornerstone for any business that relies on transportation. From delivery vans to executive cars, having comprehensive coverage ensures that your fleet is protected against accidents, theft, and third-party liabilities. Modern auto insurance policies now include features such as:

- Accident coverage and collision protection

- Theft and vandalism protection

- Coverage for vehicle repairs and replacement parts

- Liability insurance for third-party injuries or property damage

- Roadside assistance and emergency services

Choosing the right auto insurance policy involves assessing your fleet size, vehicle types, and operational risks. At im-insured.co.uk, our experts work closely with you to tailor auto insurance plans that align with your commercial needs, budget, and legal obligations.

Securing Futures with Strategic Life Insurance Solutions

Life insurance plays a pivotal role in personal and business planning. It ensures that families and key stakeholders are protected financially in the unfortunate event of an individual’s demise. Business owners, in particular, benefit significantly from specialized policies like business succession planning, key person insurance, and employee benefit schemes.

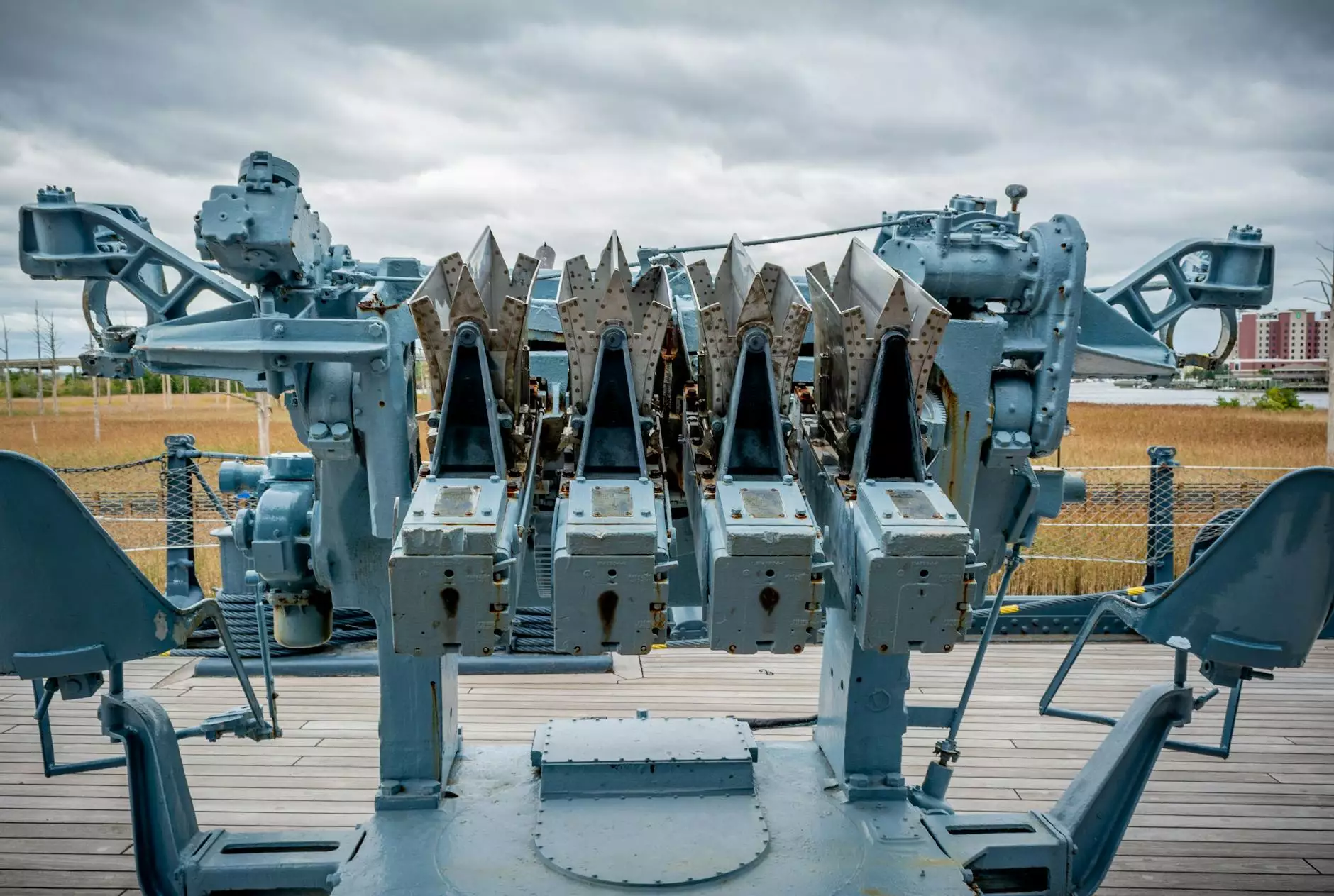

Among the many types, the military life insurance policy is a specialized product catering to military personnel and their families. It provides tailored coverage that accounts for the unique risks and exigencies associated with service in the armed forces.

Understanding the Military Life Insurance Policy

The military life insurance policy is designed to offer comprehensive protection to active-duty personnel, veterans, and their dependents. It features distinctive benefits such as:

- Enhanced coverage options aligned with military service risks

- Special premiums for service members and veterans

- Coverage that extends beyond active duty, including residual benefits for veterans

- Flexible policy terms, allowing for customizable coverage levels

- Additional features such as disability benefits and survivor payouts

This policy serves as a critical safety net, providing peace of mind to military families who face unique uncertainties. It also plays a strategic role in financial planning, ensuring that loved ones are protected regardless of life's unforeseen circumstances.

The Importance of Comprehensive Home & Rental Insurance for Business and Personal Assets

Protecting physical assets through Home & Rental Insurance is vital whether you own a commercial property, rent an office space, or safeguard your personal residence. Tailored coverage options help cover damages caused by fire, flooding, vandalism, and natural disasters. Business premises are often insured against:

- Structural damage

- Contents and inventory loss

- Liability for injuries or property damage involving visitors

- Loss of income during repair periods

For renters, insurance safeguards possessions and liability coverage for accidents on the premises. Partnering with a trusted provider like im-insured.co.uk ensures your rental or commercial property is comprehensively insured against all foreseeable risks.

The Benefits of Choosing a Professional Insurance Provider

Partnering with experienced insurance professionals offers numerous advantages:

- Expert Advice: We analyze your specific needs and recommend optimal policies.

- Customized Solutions: Tailor insurance coverage to match your individual or business requirements.

- Cost Efficiency: Access competitive premium rates through extensive market research.

- Claims Assistance: Simplified and professional support during claim processes.

- Ongoing Support: Regular policy reviews and updates to adapt to changing circumstances.

How to Select the Best Insurance Coverage for Your Needs

Choosing the right insurance coverage involves a strategic approach:

- Assess Your Risks: Identify potential threats to your assets, business operations, or personal welfare.

- Determine Coverage Needs: Decide on coverage limits, deductibles, and additional benefits.

- Research Providers: Evaluate the reputation, customer reviews, and range of services.

- Compare Quotes: Obtain detailed quotes to analyze value and coverage specifics.

- Consult Experts: Leverage professional advice to optimize your insurance portfolio.

At im-insured.co.uk, our dedicated team simplifies this process by providing personalized consultations and comprehensive solutions tailored to your unique needs.

Conclusion: Secure Your Business and Future with Reliable Insurance

In an unpredictable world, the importance of well-planned insurance strategy cannot be overstated. Whether it's safeguarding your business assets with Auto Insurance, protecting your loved ones through Life Insurance including specialized policies like the military life insurance policy, or ensuring your property is covered by Home & Rental Insurance, comprehensive coverage lays the foundation for peace of mind and sustained success.

Partnering with a trusted insurance provider such as im-insured.co.uk guarantees access to expert advice, tailored policies, and dedicated support to navigate the complex insurance landscape effectively. Invest in your future today—protect what matters most and build resilience against uncertainties with our premium insurance solutions.

Contact Us Today

To learn more about our services or to get a personalized quote, visit im-insured.co.uk or contact our customer service team. Your future security is our priority.