The Intricacies of Cloning Credit Cards: Understanding Risks and Solutions

The issue of cloning credit cards poses significant challenges not only for consumers but also for businesses operating in today's digital landscape. The increasing sophistication of cyber threats has made it imperative for all stakeholders to remain vigilant and informed. This article delves into the mechanics of credit card cloning, its implications for businesses, and practical measures for prevention.

What is Credit Card Cloning?

Credit card cloning refers to the illicit replication of a credit card's information and functionalities without the owner's consent. Criminals use various techniques to obtain sensitive data, including:

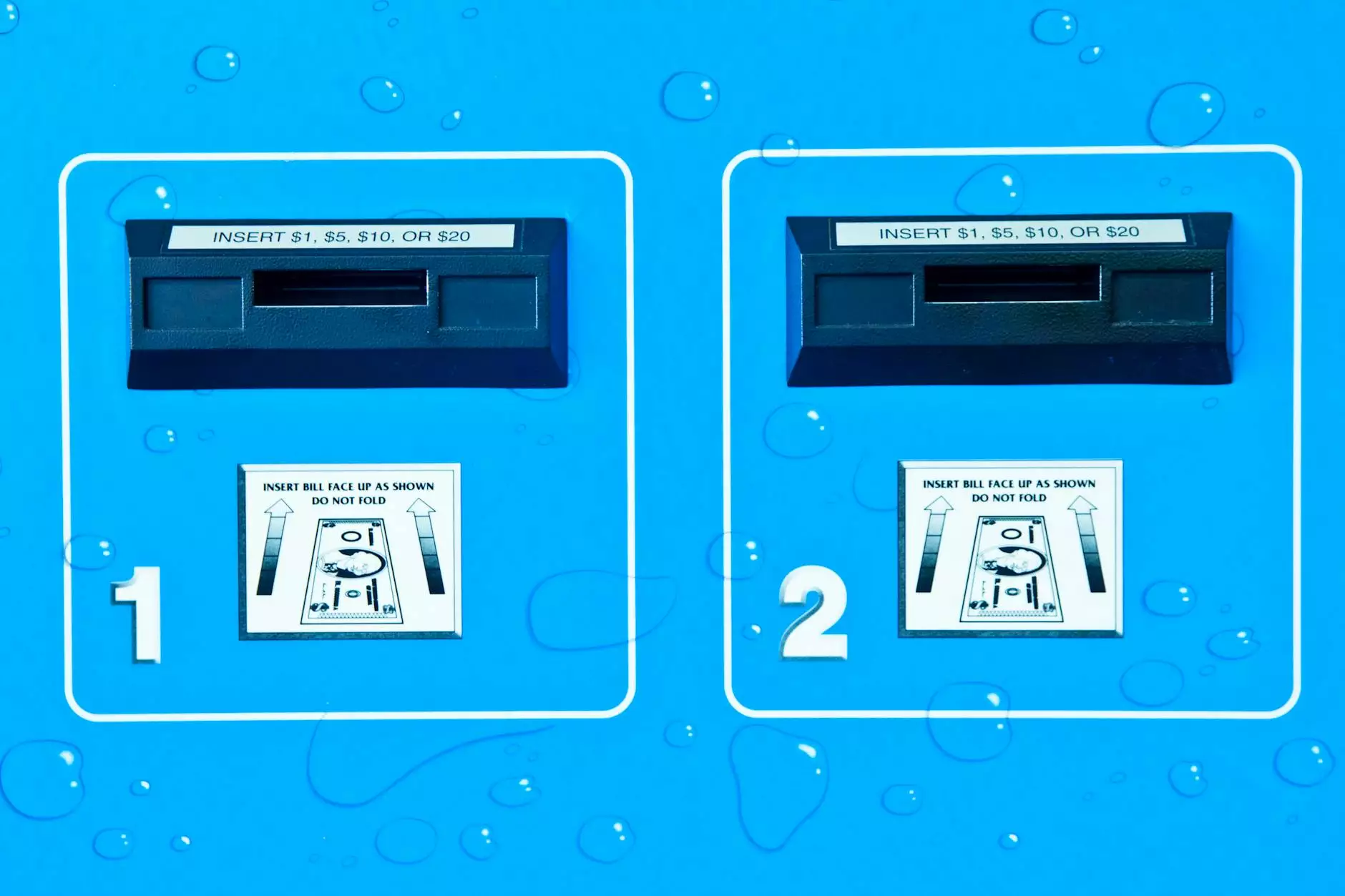

- Skimming: Devices called skimmers can be placed on ATMs or gas station card readers, allowing thieves to capture the magnetic stripe data of cards inserted into these machines.

- Phishing: Through deceptive emails or websites, fraudsters trick individuals into providing their credit card information.

- Malware: Some attackers install malware on computers to capture data directly from users' devices.

The Impact of Cloned Cards on Businesses

For businesses, the impact of cloning credit cards can be profound:

Financial Losses

In the event of fraudulent transactions, businesses may face chargebacks, leading to significant financial losses. These chargebacks can damage the reputation of businesses and result in lost sales.

Trust and Reputation

Security breaches can erode customer trust. If consumers believe their financial data is at risk, they might hesitate to engage with businesses that have not established strong security protocols.

Legal Consequences

Data breaches can also lead to legal repercussions. Businesses may find themselves facing lawsuits or fines if they fail to protect sensitive customer information adequately.

How Cloning Credit Cards Affects Consumers

Consumers are directly affected by cloning credit cards, and understanding the potential risks is crucial. Some of these impacts include:

- Financial Strain: Victims may experience temporary financial inconvenience while rectifying fraudulent charges.

- Credit Score Impact: Unresolved fraudulent charges can affect a consumer's credit score negatively.

- Identity Theft: In worse cases, data obtained can lead to identity theft, further complicating a victim's financial landscape.

Preventative Measures for Businesses and Consumers

While the threat of cloning credit cards is real, various preventative measures can be taken by both consumers and businesses to reduce vulnerabilities:

For Businesses

Implementing robust security measures is essential for businesses to protect themselves and their customers:

- Invest in Advanced Security Technology: Using EMV (Europay, MasterCard, and Visa) chip readers can significantly reduce card cloning incidents.

- Regular Security Audits: Periodically reviewing security protocols can help identify vulnerabilities before they can be exploited.

- Employee Training: Educating employees about potential phishing attempts and the importance of safeguarding sensitive information can strengthen security.

For Consumers

Consumers can take proactive steps to safeguard their financial data:

- Keep Personal Information Private: Be cautious about sharing credit card details and only provide them over secure websites.

- Monitor Financial Statements: Regularly reviewing bank statements can help identify fraudulent charges quickly.

- Use Virtual Credit Cards: Some banks and financial institutions offer services that allow consumers to generate temporary credit card numbers for online purchases.

The Role of Technology in Combating Cloning

Technological advancements have significantly contributed to combating cloning credit cards. Here are some innovations that can enhance security:

Contactless Payments

Adopting contactless payment methods adds an extra layer of security. These payments use encryption and tokenization, making it difficult for fraudsters to clone information.

Biometric Authentication

Employing biometric authentication mechanisms—such as fingerprint recognition—can prevent unauthorized access to credit card information.

Smart Wallets and Digital Currencies

Emerging technologies like smart wallets and digital currencies offer enhanced security features that can mitigate the risks associated with traditional credit cards.

Educational Resources and Support

Both businesses and consumers can benefit from various educational resources:

Webinars and Workshops

Many organizations offer free webinars and workshops that educate individuals about secure practices for handling financial data.

Government Initiatives

Government agencies often provide resources and initiatives to help citizens protect against identity theft and fraud.

Conclusion: Staying One Step Ahead of Cloning Credit Cards

In conclusion, the issue of cloning credit cards remains a significant challenge for both businesses and consumers. By understanding the risks involved and implementing effective strategies for prevention, all parties can better safeguard their interests. Knowledge, technology, and vigilance are key in staying one step ahead of fraudsters.

As the landscape of financial transactions evolves, so too must the measures we take to protect ourselves from threats to our financial security. Through continued education and the adoption of advanced technology, we can create a safer environment for our personal and professional transactions.